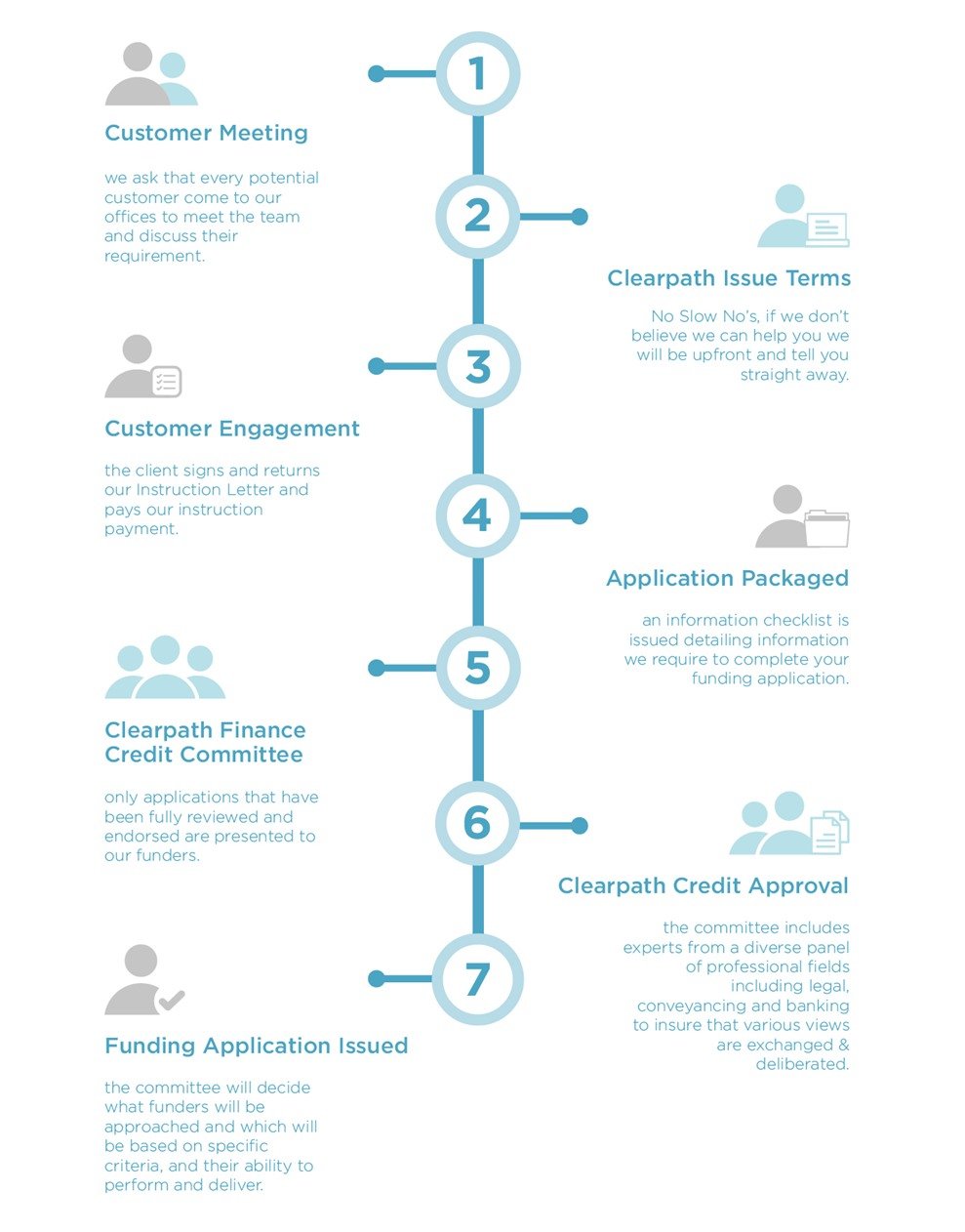

Our Process

The Clearpath Finance Process

-

GET STARTED

Get in touch with us and engage with one our advisors who will discuss your objectives and business needs..

Our advisor will quickly give you an initial outline of what your lending threshold may be.

All fees are outlined and presented for your consideration and typical timelines are discussed.

-

GET SET

Once instructed, our team looks at all the relevant documentation and information required to prepare a funding proposal.

Using our insight and industry knowledge, Your Clearpath advisor assesses our panel of more than 50 lenders to find the most appropriate for your requirements, then negotiates directly on your behalf for the most favourable terms possible.

To process your application, you must provide:

The last 2 years trading accounts

The last 3 months business bank statements

Photo ID and proof of address -

GET SORTED

If successful, you will be presented with an offer / offers for your consideration and approval.

Unlike other brokers, a Clearpath Finance advisor will stay involved in the loan agreement throughout every step to ensure an efficient completion for you.